Starting a music institute is an exciting journey, but beyond the passion for teaching music, there’s a crucial question every institute owner must ask: Is my institute legally protected?

Many music academy owners overlook the importance of legal registration, assuming that if they have students and a rented space, they are good to go. However, operating without proper legal recognition can expose you to multiple risks, including fines, tax issues, and even sudden shutdowns due to non-compliance with local laws.

In this guide, we will break down why registering your music institute is essential, the types of legal registrations available, and the step-by-step process to legally register your music institute so you can operate stress-free.

Let’s dive in! 🎵

1. Why Should You Register Your Music Institute?

Many new music institute owners hesitate when it comes to legal registration because they think it’s a complicated and expensive process. However, registering your music institute comes with numerous benefits that can save you from future problems and even help your business grow. Here’s why:

1. Legal Protection & Credibility

If your institute is not registered, it is not legally recognized as a business. This means if someone copies your brand name, refuses to pay fees, or takes legal action against you, you will not have legal rights to defend yourself properly. Registration gives your institute official credibility, making it trustworthy in the eyes of parents, students, and financial institutions.

📌 Once your institute is registered, enquiries will follow — and handling them well sets you apart from day one. Download our Enquiry Management Sheet to log details, follow up on time, and present yourself like a professional.

2. Access to Government Benefits & Tax Exemptions

Governments in different countries offer special benefits, grants, and tax exemptions for registered educational institutions. These can include:

- Tax reductions for educational businesses

- Access to business loans and startup grants

- Subsidies on rent, electricity, and infrastructure

Without registration, you miss out on these valuable financial aids!

3. Expansion & Franchising Opportunities

If you ever want to expand your music academy, open multiple branches, or offer franchise options, you will need to register your music institute legally. A registered music institute can sign franchise agreements, apply for business loans, and even collaborate with international music organizations.

4. Easier Bank Account & Online Payments

Most payment gateways, banks, and loan providers require business registration before allowing you to open a business account or accept online payments. Without registration, you may be forced to accept payments through personal accounts, which can lead to tax complications and trust issues with students and parents.

5. Avoid Legal Troubles & Penalties

Many institute owners start operating without registration, thinking they will “do it later.” However, if the government finds out you are running an unregistered business, you may face penalties, sudden closure, or even legal action.

👉 Moral of the story? It’s always better to register early and protect yourself from future troubles.

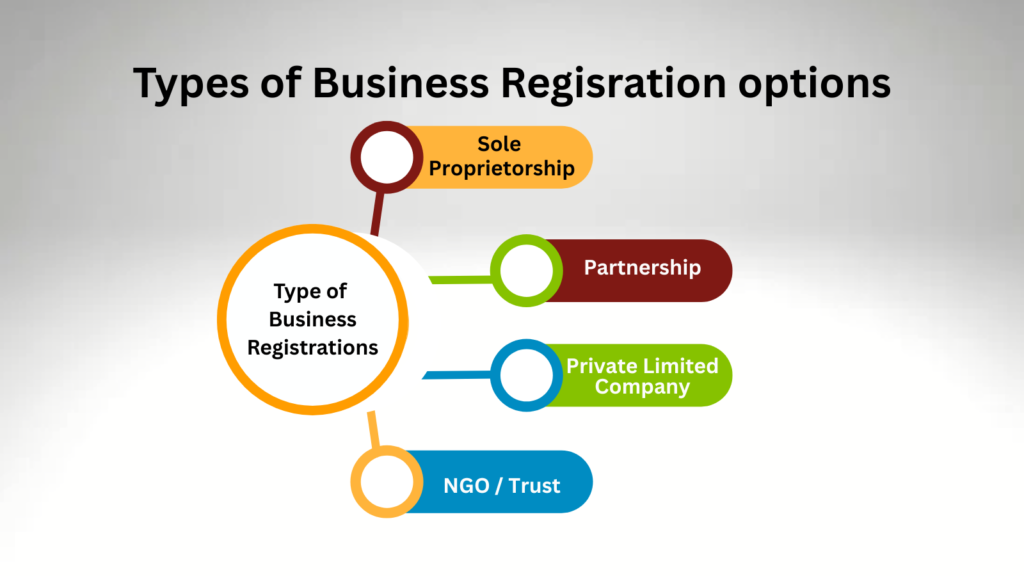

2. Types of Registrations Available for Music Institutes

Now that we understand why you should register your institute, let’s explore the different types of registrations available based on the size and goals of your music academy you can choose any type of registration to register your music institute.

Each registration type has its pros and cons, so choosing the right one depends on your business model.

1. Sole Proprietorship (For Small Institutes & Individual Teachers)

Best For: Single-person businesses, home-based music teachers, or small institutes with no partners.

A sole proprietorship is the simplest and cheapest way to register your music academy. It means that you (the owner) and the business are the same legal entity.

Advantages:

✔️ Easy to register with minimal paperwork

✔️ Lower tax rates compared to companies

✔️ Full control over business decisions

Disadvantages:

❌ The owner is personally responsible for debts & losses

❌ Difficult to get bank loans or investors

👉 Ideal for: Individual music teachers running small-scale academies without big expansion plans.

2. Partnership Firm (For Co-Founded Music Institutes)

Best For: Music academies started by two or more people.

If you have a business partner or co-founder, then registering as a Partnership Firm is a better option than sole proprietorship.

Advantages:

✔️ Easy to set up and manage

✔️ Profit/loss is shared between partners

✔️ More credibility than a sole proprietorship

Disadvantages:

❌ Disputes between partners can lead to conflicts

❌ Unlimited liability (partners are personally responsible for business debts)

👉 Ideal for: Two or more friends/co-founders starting a music academy together.

3. Private Limited Company (For Large & Professional Music Academies)

Best For: Music institutes that plan to expand, hire multiple staff members, and operate professionally.

A Private Limited (Pvt Ltd) Company is a legally separate entity from its owners, which means the owners’ personal assets are protected if the business fails.

Advantages:

✔️ Limited liability (owners are not personally responsible for debts)

✔️ Easier to raise funds from investors & banks

✔️ Gives a professional image to parents & students

Disadvantages:

❌ More paperwork & legal formalities

❌ Higher tax rates compared to proprietorship

👉 Ideal for: Large music institutes planning expansion or franchising.

4. NGO, Trust, or Society (For Non-Profit Music Institutes)

Best For: Music academies that provide free or subsidized education.

If your music institute focuses on social work, charity, or free education, you can register as an NGO, Trust, or Society.

Advantages:

✔️ 100% tax exemption under non-profit laws

✔️ Eligible for government & private donations

✔️ Can receive CSR (Corporate Social Responsibility) funding from big companies

Disadvantages:

❌ Cannot distribute profits among owners

❌ Strict regulations & legal requirements

👉 Ideal for: Music institutes focused on free music education, scholarships, and community service.

3. Step-by-Step Process to Register Your Music Institute

The registration process varies based on the type of business structure you choose. However, here’s a general step-by-step guide that applies to most registrations in India:

1. Decide Your Business Structure

Before starting the registration process, you must choose the type of registration that best suits your music institute:

- Sole Proprietorship – Best for individual music teachers or small academies

- Partnership Firm – Best for academies run by two or more partners

- Private Limited Company – Best for professional expansion & franchising

- NGO/Trust/Society – Best for non-profit academies

Once you decide on the structure, you can proceed with the official registration.

2. Choose a Unique Name for Your Music Institute

Your business name is your brand identity. When selecting a name, ensure that:

- It is unique and not already taken by another institute

- It reflects the essence of your academy (Example: “Symphony Music Academy”)

- It is easy to remember and pronounce

👉 Pro Tip: Check the availability of your business name on the Ministry of Corporate Affairs (MCA) website if you are registering as a Private Limited Company.

3. Register Your Business (Based on Your Chosen Structure)

Depending on the registration type, you must submit specific documents to the government. Here’s what you need:

✅ Sole Proprietorship Registration

- PAN card of the owner

- Aadhaar card

- GST registration (if applicable)

- Business name registration (Optional but recommended)

✅ Partnership Firm Registration

- Partnership deed

- PAN cards of all partners

- Address proof of business location

- GST registration (if applicable)

✅ Private Limited Company Registration

- Director Identification Number (DIN)

- Digital Signature Certificate (DSC)

- Memorandum of Association (MOA) & Articles of Association (AOA)

- PAN & Aadhaar cards of directors

- Business bank account setup

✅ NGO/Trust/Society Registration

- Trust Deed (for Trusts) or Memorandum of Association (for Societies)

- Registration with Registrar of Societies or Charity Commissioner

- PAN card of the trust/society

- 12A and 80G registration for tax exemption (if applicable)

4. Get GST Registration (If Required)

If your annual revenue exceeds ₹20 lakh, you need to register for Goods & Services Tax (GST).

👉 Apply for GST registration at: GST Portal

Benefits of GST Registration:

- Legally collect and pay taxes

- Claim input tax credit (reduces your tax burden)

- Makes your academy look more professional to students and parents

5. Open a Business Bank Account

Once your institute is registered, open a separate business bank account to handle all transactions professionally. Banks typically require:

- Business registration certificate

- PAN & Aadhaar of the owner/directors

- GST certificate (if applicable)

👉 Why is this important? Using a business bank account prevents tax issues and improves financial management.

6. Apply for MSME/Udyam Registration (Optional, but Highly Beneficial!)

The MSME (Micro, Small, and Medium Enterprises) registration, also known as Udyam Registration, provides special benefits to small businesses, including music institutes.

👉 Apply at: Udyam Registration Portal

Benefits of MSME/Udyam Registration for Music Institutes:

- Eligibility for government subsidies & schemes

- Lower interest rates on business loans

- Tax benefits & exemptions

- Easier access to bank financing

✅ Documents Needed:

- Aadhaar card of the owner

- PAN card

- Business details (name, address, bank account)

4. Tax Benefits & Government Schemes for Registered Music Institutes

Once your music academy is legally registered, you can enjoy tax benefits and apply for government schemes. Here are some key benefits:

1. Tax Exemptions for Educational Institutes

Registered educational institutions can apply for tax exemptions under Section 10(23C) of the Income Tax Act.

👉 Who qualifies?

- Music academies running as non-profits or NGOs

- Institutes recognized by a government authority

Benefit: 0% tax on income if you meet the eligibility criteria!

2. Startup India Scheme Benefits

If your music institute is registered as a Private Limited Company or LLP, you can register under Startup India to enjoy:

✔️ 3-year tax holiday (no income tax for the first 3 years)

✔️ Easier bank loans and funding support

✔️ Exemption from complex labor laws

👉 Apply at: Startup India Portal

3. Subsidized Loans & Financial Support

Registered music institutes can apply for Mudra Loans, SIDBI Loans, and Education Sector Grants for expansion.

Example: Under the PM Mudra Yojana, small businesses can get loans up to ₹10 lakh without collateral.

👉 Check loan details at: Mudra Loan Website

Is It Worth to Register Your Music Institute?

Absolutely! Registering your music academy not only protects you legally but also helps in growth, credibility, and financial benefits.

✅ Key Takeaways:

🎵 Legal Protection: Shields you from legal risks & penalties

🎵 Financial Benefits: Access to tax exemptions & government grants

🎵 Professionalism: Easier to gain students’ trust & collect payments

🎵 Expansion Ready: Eligible for loans & partnerships

By taking the right steps now, you can build a strong, legally secure, and financially successful music institute! 🎶

Do You Have Questions to Register Your Music Institute?

If you still have doubts, consult a chartered accountant (CA) or legal advisor to choose the best option for your academy.

👉 For official registration guidelines, visit the Ministry of Corporate Affairs (MCA) website: MCA Website

You May Also Like: Free Checklist: 10 Factors to Consider Before Renting a Space for Your Music Institute